Global green finance rises over 100 fold in the past decade -study

Reuters

April 1, 2022

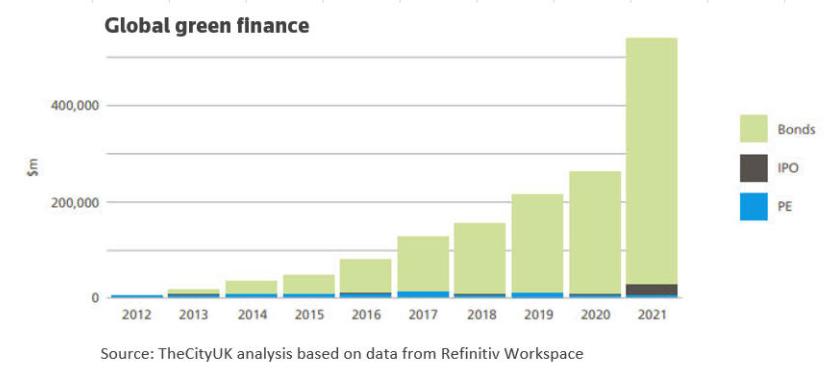

March 31 (Reuters) - Global green financing, aimed at environmentally friendly projects around the world, has grown over 100 times in the past decade, a new study from the TheCityUK and BNP Paribas showed.

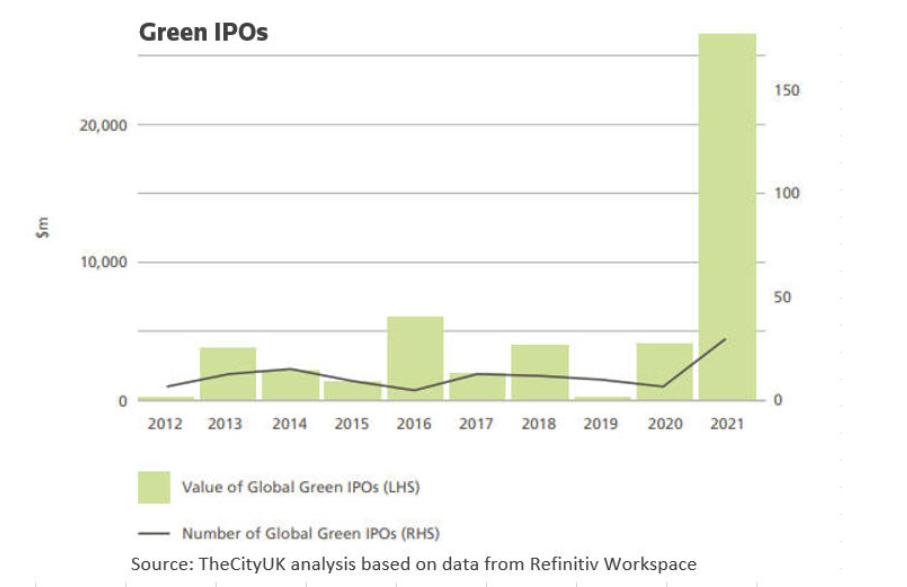

Global borrowing by issuing green bonds and loans, and equity funding through initial public offerings targeting green projects, swelled to $540.6 billion in 2021 from $5.2 billion in 2012, according to the research.

TheCityUK is an industry-led body representing UK-based financial and related professional services.

The jump in issuance underscores the growing push from governments and corporations to try to rein in carbon emissions and achieve climate goals.

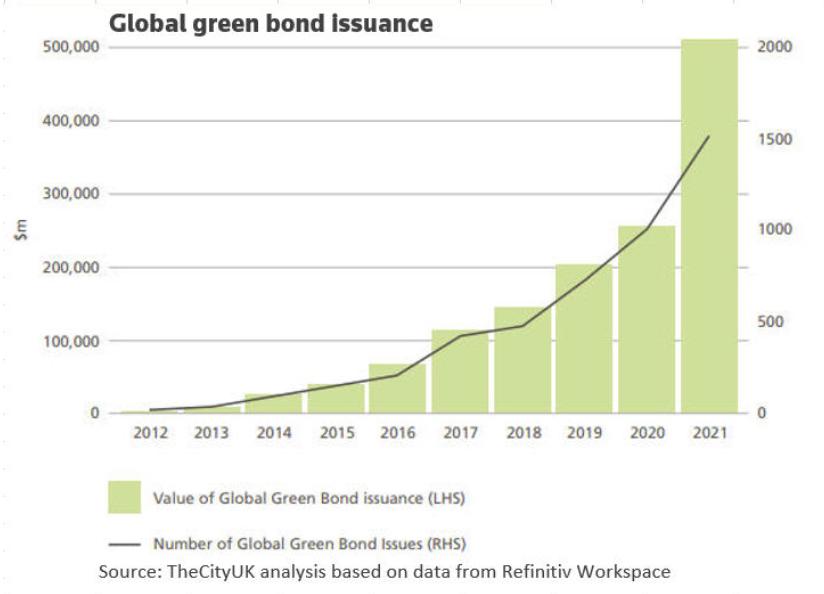

The data showed green bonds accounted for 93.1% of total green finance globally between 2012 and 2021. In 2021, global green bond issuance stood at $511.5 billion, compared with $2.3 billion in 2012.

China and the U.S. accounted for 13.6% and 11.6% of the green bond issuance between 2012 and 2021, the data showed.

They were followed by France and Germany, with about 10% each of the issuance of green bonds during the period.

The share of green finance in the total finance market was about 4% in 2021, compared with around 0.1% in 2012.

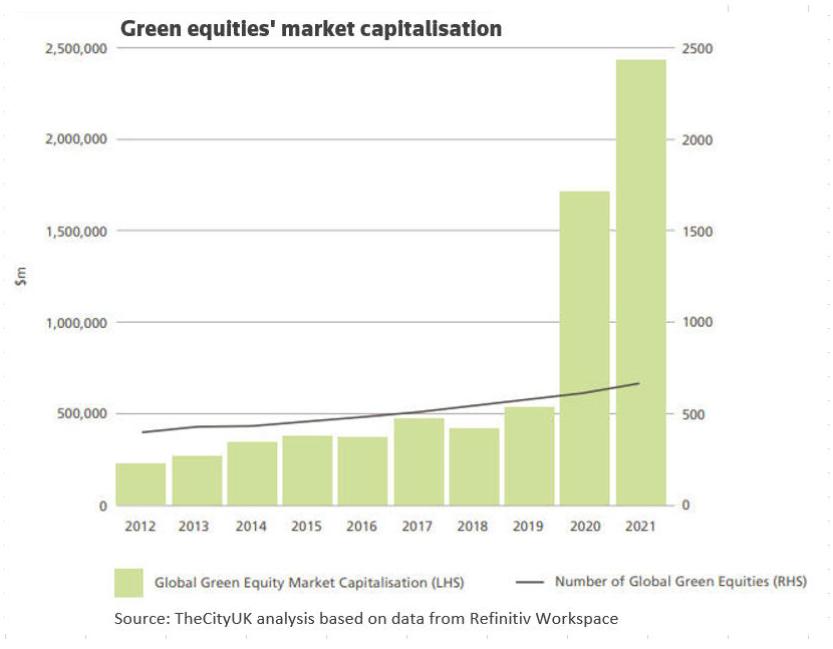

The number of publicly traded companies involved in green activities grew from 401 companies in 2012 to 669 in 2021, the data showed.